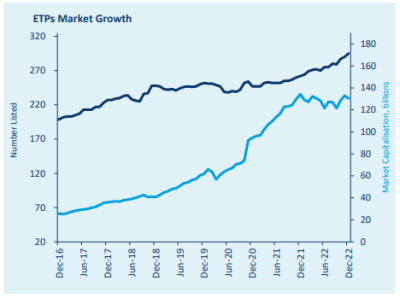

There’s no doubt that Exchange Traded Products (ETPs) including ETFs have taken off in popularity over the past few years. Between January 2017 to December 2022, the number of ETPs listed on the ASX has grown from 202 to 294, with the number of issuers more than doubling in that period from 16 to 38. The market cap value of ETPs has likewise grown from $25.234 billion to $130.528 billion in that same period.

Over the same period, LICs and LITs (Listed Investment Trusts) have seen a slight contraction in the number of listed entities, and modest growth in market cap value.

There are a few reasons that account for these relative movements in funds.

Cost

ETFs

A key driver for the uptake in ETFs as a favoured investment is cost. Most (but not all) ETFs are designed as passive portfolios, requiring little management by the provider. ETFs were originally created to track well known stock market indexes such as the S&P 500 etc. The first ETFs brought to the Australian market in 2001 were much the same, tracking the SPDR S&P/ASX 50 index (ASX:SFY) and the SPDR S&P/ASX 200 index (ASX:STW). These were low-cost products, with initial management fees sitting under 1%. As more and more ETFs were listed, the breadth of available indexes grew significantly, covering sectors such as property, global equities, infrastructure, fixed income, commodities etc. All offering a typically low-cost product to gain exposure to these differing asset classes.

Leave a Reply